From Lithium Extraction to Lithium Recycling

The competition of car manufacturers for transformation to electric vehicles has resulted in high demand for lithium, causing Lithium prices to have increased about five times during the last year. This matter is attributed to the fact that lithium production methods have yet to be developed to meet its vast demand. Despite theoretically being abundant sources of lithium, the process is not efficient enough. Hence, car manufacturers have noted this and entered the lithium mining industry. Elon Musk tweeted:” Price of lithium has gone to insane levels! Tesla might have to get into the mining & refining directly at scale unless costs improve.”

To better understand the lithium extraction process, here are two primary sources: brine and Lithium rocks. Underground brine with a high lithium content is pumped to low-depth basins and kept for a long period to allow the water to evaporate by sunlight and increase lithium concentration. Following chemical processing, a battery-grade lithium precursor is prepared. One of the world’s largest lithium salt lakes is Salar de Atacama, located between Chile and Argentina. But leaks of highly concentrated brine to the environment introduce new environmental challenges. Minerals such as Spodumene, Lepidolite, and Petalite, which are lithium-containing aluminosilicates known as “Hard Rock,” are another source of Lithium. Spodumene is the most abundant and is roasted at a high temperature (about 1100°C) to be prepared for chemical reactions. The cooled spodumene is leached with sulfuric acid to separate lithium from other ions such as aluminum, iron, and magnesium. The biggest spodumene lithium mine is the Greenbushes mine in Western Australia.

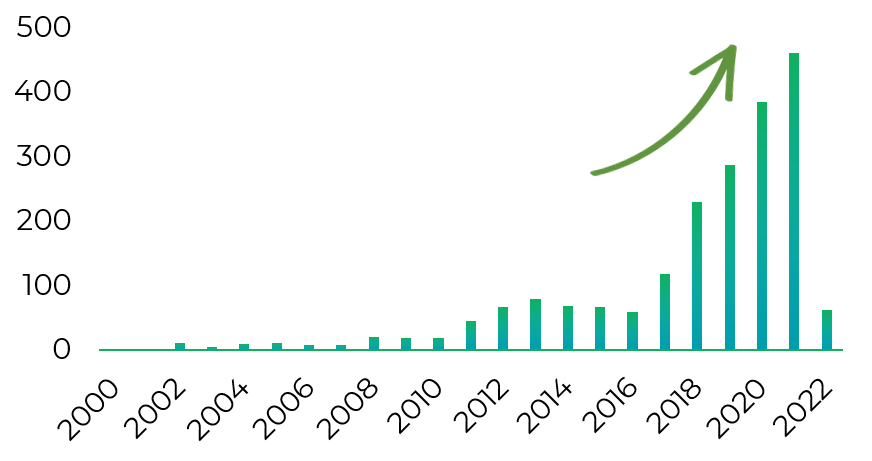

As an innovation indicator, patents can reveal the future of technology. Our search on lithium extraction and recovery reveals that the trend in patent registration in this field is exponentially growing, especially after 2016, which is similar to most of the subjects in lithium-ion battery technologies (Figure 1).

Figure 1. Patent timeline in field of Lithium extration

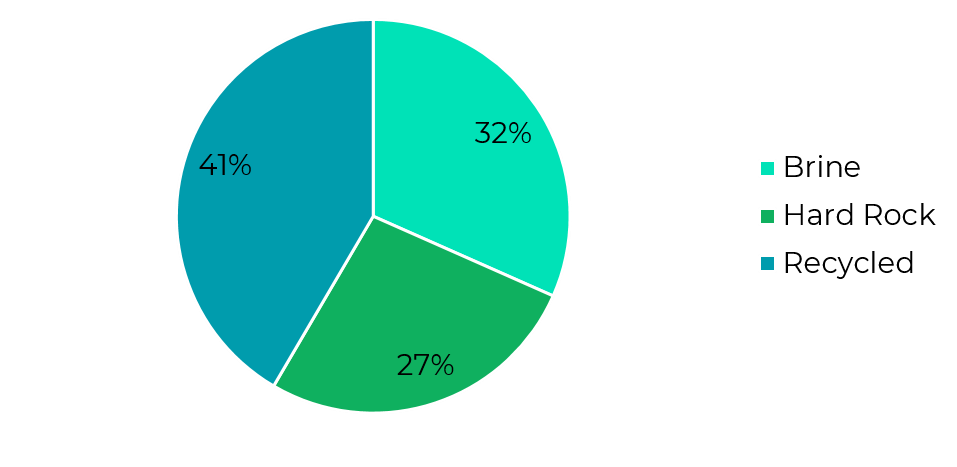

As shown in fiqure 2, Forty-one percent of patents describe the recovery and recycling of lithium, 32% extract lithium from brine, and the rest are patents on hard-rock sources.

Figure 2. Patent publication distribution in field of Lithium extraction

Most of the IP holders are Chinese universities and institutions. However, companies such as JX Nippon Mining & Metals, Posco, Jiangxi Nanshi Lithium, Jiangsu Zhongnan Lithium, Simbol Inc., BASF, Brunp Recycling, Lithium Australia, Nemaska Lithium, Sumitomo Metal Mining and Albermarle are among top patent owners.

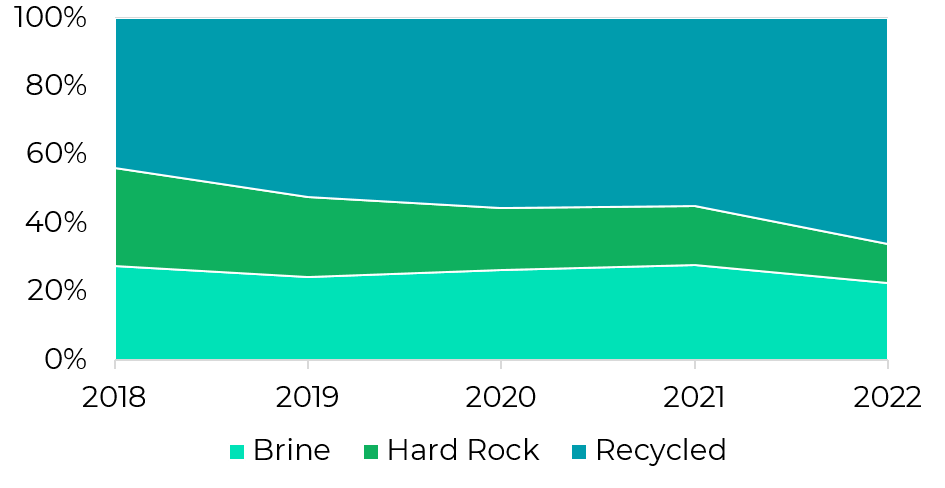

A deeper look into the trend shows that the share of lithium recycling is increased during the last five years compared to the extraction of lithium, especially from hard rock (Figure 3). The high cost and low efficiency of mining and environmental concerns lead the technology to move from extraction to recycling of lithium. Even though the technology is in the development stage, it is predicted that a considerable amount of lithium for lithium-ion batteries will be obtained from waste batteries soon.

Figure 3. Share of Lithium sources during years