Graphite Anode Its Substitutes Market

Nowadays, the supply chain for nickel, cobalt, and lithium, as critical metals of batteries, is lagging and cannot keep up with battery demand for electric vehicles. Contrary to this, graphite is neglected as a material of the anode, being the only dominant material. Sixty-six kilograms of graphite are used in an electric car, and 18 percent of a battery pack is made from graphite, much more than metals facing shortages.

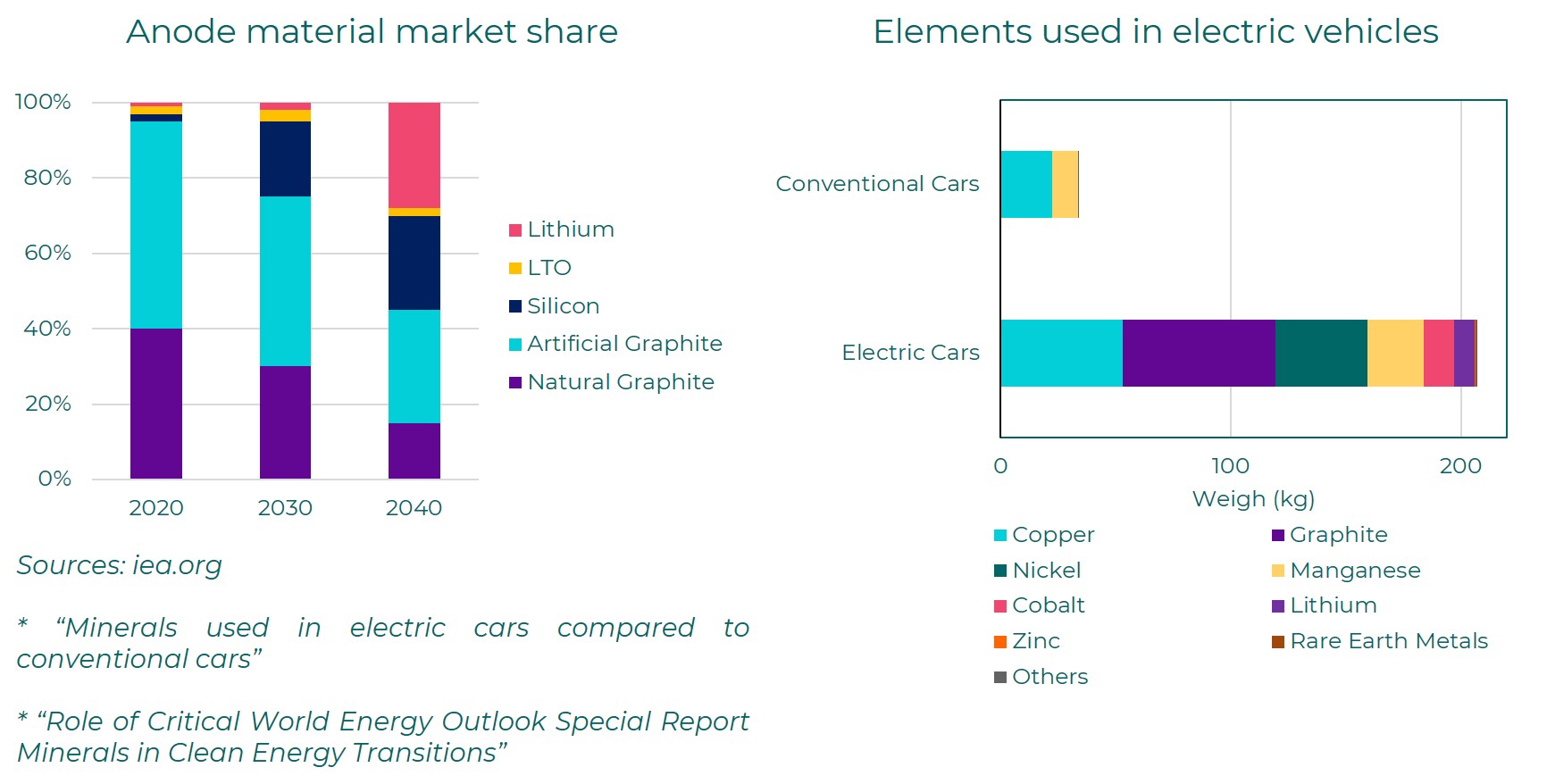

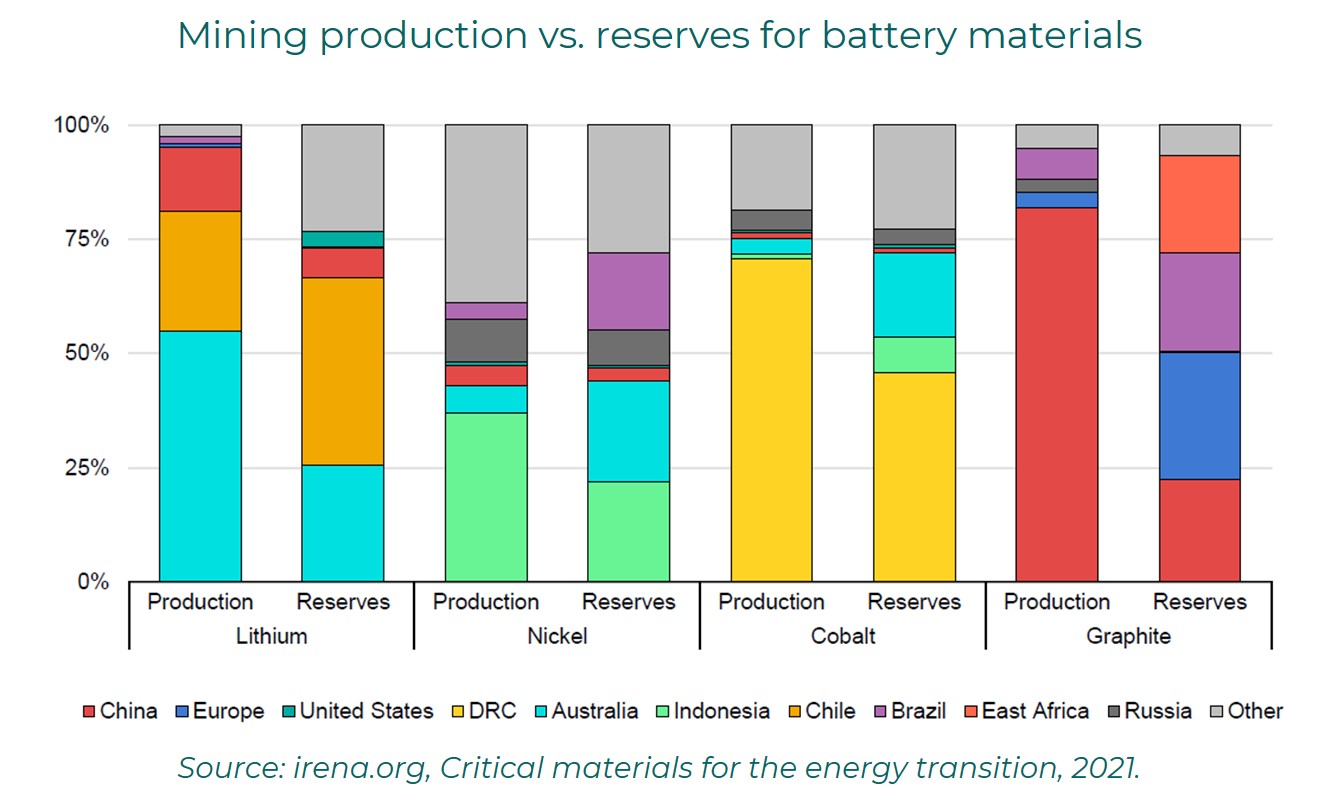

The largest producers of lithium are Australia and Chile. Most nickel is produced in Russia and Indonesia, while cobalt is sourced from the Democratic Republic of the Congo. Meanwhile, China manufactures over 75 percent of the graphite used in batteries. Energy and military shortage was triggered by a 700 percent price increase worldwide in 2012 due to the rare earth metals crisis. Russia also supplies up to 14 percent of nickel products in the world. Due to the Russia-Ukraine conflict, nickel prices jumped to 400 percent on the London Metal Exchange, which can increase an electric vehicle's production cost by 3000 USD. This experience has shown that battery industries depend on China's graphite, which can severely impact future electrification. Hence, a significant increase in graphite mining and production is needed to increase the supply of graphite by 2040, as there was 140000 tons of graphite demand in 2020 for electric vehicles, compared to 3.5 million tons will be reached by 2040 for batteries.

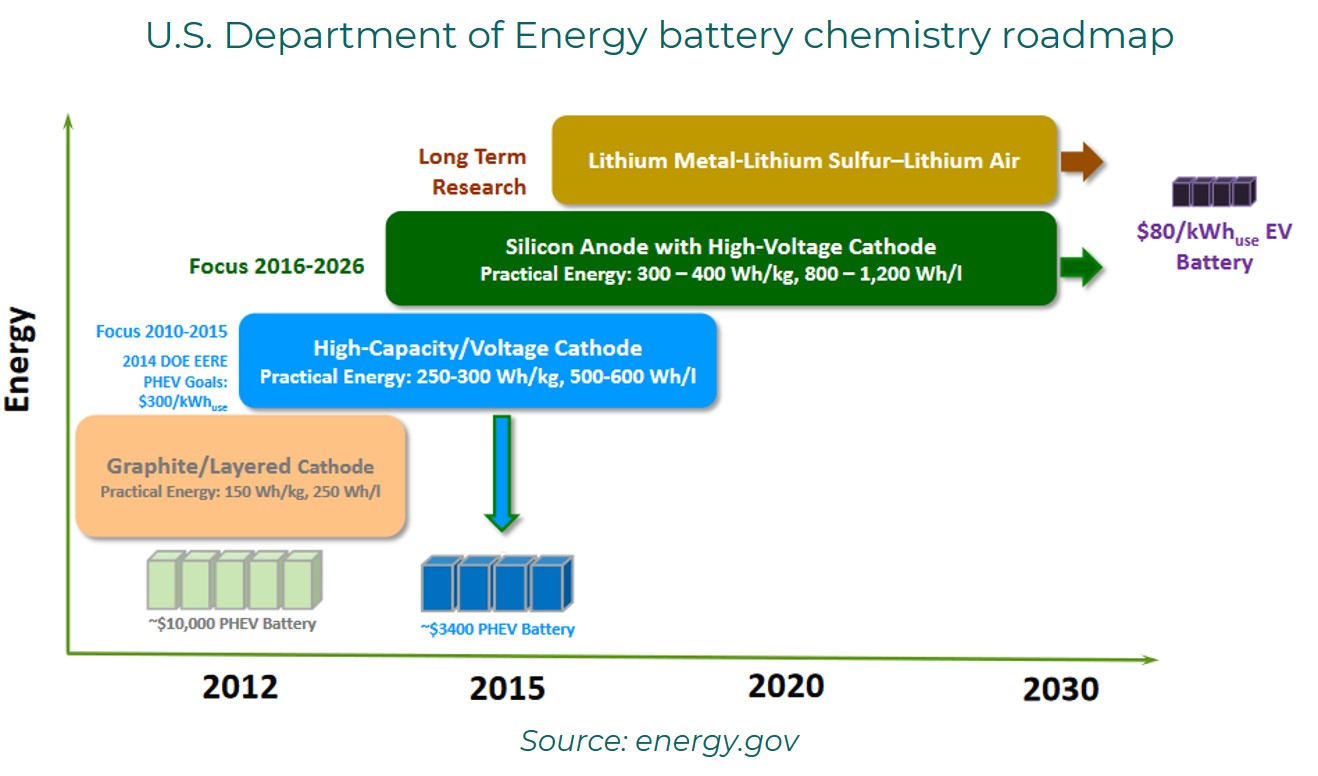

Interestingly, the United States relies solely on graphite imports, with almost no share in graphite production. By 2040, the percentage of silicon-containing graphite anodes will increase to 15, and graphite application in anodes will be less than half of what it is today. Despite no interest in graphite production in the United States, most small and medium-sized battery companies developing new anode materials such as silicon and lithium metal anodes are located in this country. A battery chemistry roadmap released by the U.S. Department of Energy shows that after 2020, new chemistries have replaced graphite as the anode material. According to this roadmap, silicon anodes, lithium-sulfur batteries, and solid-state batteries have reduced this country's need for graphite.